CHANDLER CHAPTER 13 BANKRUPTCY LAWYERS

In Chandler, Arizona, a Chapter 13 bankruptcy is also known as a “wage-earners” bankruptcy, because there is simply a reorganization of the debtor’s financial affairs rather than the elimination of debt. A Chapter 13 is geared toward helping debtors with consistent incomes make reduced, affordable payments on their financial obligations through a payment plan made for a specified period of time. The new plan is typically stretched out between 3-5 years.

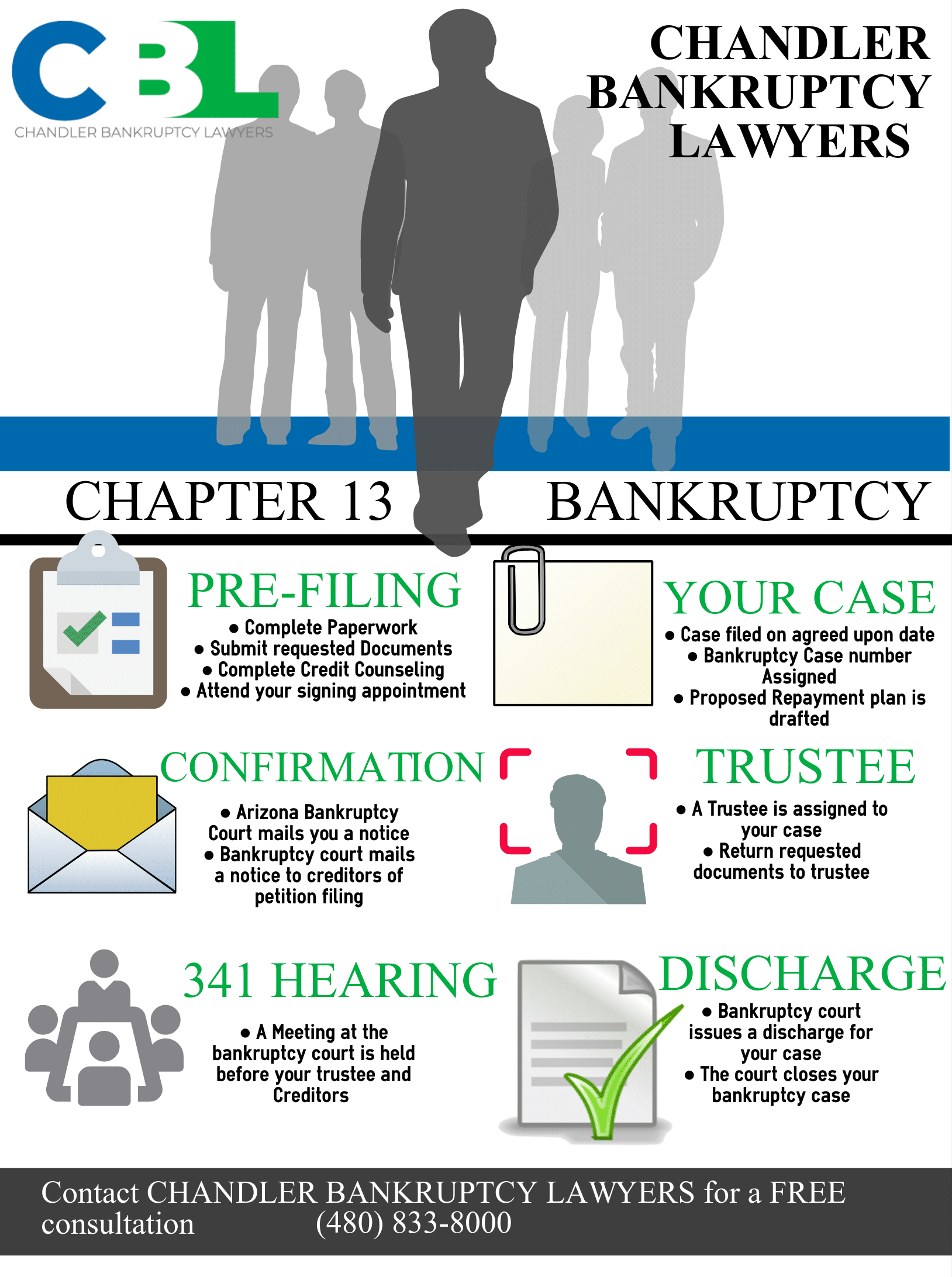

The person filing for a Chapter 13 bankruptcy works directly with their bankruptcy attorney to establish a proposed payment plan, which is then approved by bankruptcy court. The goal of the payment plan is to reorganize the debts owed into a more affordable repayment strategy. Once the payment plan is successfully completed over the next 3-5 years, any remaining debt is typically discharged by Arizona bankruptcy court.

CHANDLER, ARIZONA CHAPTER 13 FAQs

Why Should You Choose a Chapter 13 Bankruptcy?

Depending on your financial situation, a Chapter 13 may be the best solution for debt relief. One of the biggest draws to a Chapter 13 bankruptcy is the added protections that are not included in a Chapter 7 or Chapter 11. Any individuals facing a foreclosure, repossession, back tax debt, or other tax concerns may want to discuss a Chapter 13 with our Chandler Bankruptcy Law Firm.

Individuals with non-dischargeable debts such as fraud, child support, student loans, or other circumstances may also wish to consider a Chapter 13 bankruptcy, as their required payments are reorganized into more affordable amounts. Sole proprietors may also benefit from a Chapter 13 bankruptcy, if they prefer to continue operating their business without harassment from the court or creditors.

Who can file for Chandler Chapter 13 Bankruptcy in Chandler, Arizona?

Before an individual can file for a Chapter 13 bankruptcy, they must meet certain income requirements to be eligible. They must be below the maximum debt thresholds laid out by the law in order to file. We recommend taking advantage of our FREE debt evaluation consultation with our Chandler Bankruptcy Lawyers to determine if you qualify for a Chapter 13 bankruptcy.

No matter your financial situation, My AZ Lawyers are fully dedicated to helping you be successful in the Chapter 13 bankruptcy process from start to finish. We know the process takes 3-5 years, and we are in it for the long haul with you, every step of the way.

Contact us today for a FREE bankruptcy consultation. We offer: Same Day Appointments, Payment Plans for EVERY Budget, and have some of the lowest legal fees in Chandler, Maricopa County, and throughout Arizona.

(480) 448-9800 for an Experienced Ch 13 Bankruptcy Attorney

Call and schedule a free debt evaluation with our Chandler Ch 13 bankruptcy lawyers. Additionally, find out if you pass the means test and qualify for the protection of a Chapter 13 bankruptcy in Chandler, Arizona.

When to consider Chapter 7 Bankruptcy in Chandler, Arizona

- Chapter 7 erases most, if not all, debt.

- You can receive a fresh financial start with a clean slate.

- If you are facing wage garnishment.

- Once you’ve filed, creditors must stop calling you.

- Chapter 7 stops people from harassing you in attempt to collect money.

- Additionally, filing bankruptcy may allow you to save your home from foreclosure.

- There is exempt property that you may keep in a chapter 7 bankruptcy.

- Also, filing chapter 7 bankruptcy stops a vehicle repossession in most cases.

- bankruptcy stops utility service shut-off

- You can use Chapter 7 bankruptcy to get rid of credit card debt.

- A Chapter 7 filing erases medical debt.

- Declaring bankruptcy allows you to take control of your debt.

- End the stress and sleepless nights brought on by debt.

- Get yourself a “Fresh Start”. File chapter 7 bankruptcy.